Learn about upcoming events and the latest startup news—delivered to your inbox weekly.

The southeastern U.S. produces 20% of American GDP and is home to half of America’s fastest growing cities. In addition to 84 Fortune 500 companies, 15% of the wealthiest Americans and six leading American universities, more than 2,335 startups called the Southeast home (as of 2018). Yet, despite economic stability, a rapidly growing talent pool, and public-private emphasis on innovation, only 5.3% of 2018’s record-breaking venture capital funding found its way into the region.

Together, we set out to create a living and breathing resource to help connect local startups with funding opportunities in the Southeast. We seek to drive founders and funds to look beyond their own city limits and consider the collective potential of a collaborative Southeast (#BuildInSE). New industries and emerging business models require access to diverse capital sources made possible by cross-regional connectivity.

View the Southeast Capital Landscape here.

For this project, we defined the Southeast as a collection of states including Alabama, Florida, Georgia, Kentucky, Mississippi, North Carolina, South Carolina, Tennessee, Virginia, & West Virginia. This report is a high-level illustration of the Southeast Capital Landscape that seeks to outline key organizations, investors, and trends throughout the region. Data was aggregated and analyzed from PwC MoneyTree Reports, BIP Capital, Crunchbase, and self-reported by accelerators, entrepreneurs, and investors from within the region.

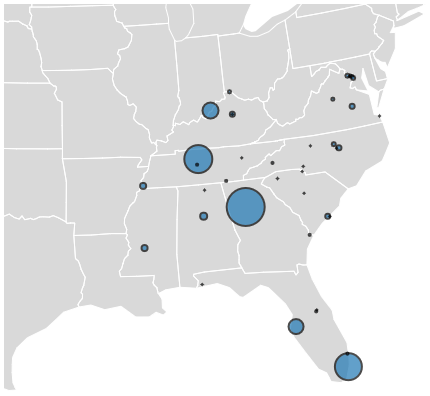

Number of Firms by City

Here’s What We Found

There are over 200 firms who are actively investing in pre-seed to growth stage startups across a broad range of industries.

- The Southeast is experiencing large amounts of growth in terms of startup creation, venture fund creation, and venture investing. This is driven by 5 metropolitan startup locations—Atlanta, Miami, Nashville, Louisville, and Tampa Bay—where the majority of early-stage firms exist.

- We will continue to see growth in new startup creation with a total of 14 accelerator programs across the Southeast, two of which have an internationally-recognized presence and network—Techstars (Atlanta) and 500 Startups (Miami).

Healthcare Leads the Way

Healthcare and enterprise technology are the two most predominant industries where firms are investing in startups.

- With Fortune 500s like UPS, Humana, Duke Energy, Raymond James, and Bank of America calling the Southeast home, this area of investment focus comes as no surprise. The presence of Fortune 500s often equates to more available subject matter experts, high net-worth individuals, customer channels, and potential acquirers in a region.

- With a growing presence of Fortune 500 companies moving employees to Southeast offices (83 total), we can expect healthcare and enterprise technology startups to continue to attract large amounts of investor capital.

Number of Firms by Industry

Number of Firms per State

Unevenly Distributed

There are large jumps within the region in terms of total capital resources investing in startups occurring between the first (FL/GA/TN), second (KY/VA/NC), and third (AL/SC/MI) tiers.

- Florida is home to the largest number of early-stage firms in the Southeast (nearly 24%), which is likely attributed to its fourth-place rank in the United States for the number of accredited investors.

- Atlanta is home to the most firms of any city in the Southeast by a factor of 10, at 38 total firms. This is likely attributed to Tech Square: the highest density of startups, corporate innovators, and academic researchers in the entire southeastern United States.

Moving Forward

We believe conveners and community partners can help provide transparency and education to the process of starting and scaling a startup. Our hope with this list is that startups can more easily find local capital resources and that funding opportunities will be better distributed throughout the Southeast—no matter where you are located.

View the Southeast Capital Landscape here.

Note: This is a list of capital providers of venture-backed startups in the southeastern United States that are currently active as a firm or investor. To include any firm or investor we did not already surface, please fill out this form.

Interested in learning more about the southeastern startup community? Find an abundance of resources and expertise focused on highlighting the events, opportunities, and narratives of folks building in the Southeast shared here: Upside, Southern Startup Report, Southern Alpha’s LaunchLetter, Hypepotamus.

Meet the collaborators

Collaboration, as demonstrated through this project, is vital to taking the Southeast to the next level in growing and retaining more high-value companies. Here are the organizations that helped make this report a reality:

Build in SE

At Build In SE, our mission is to increase the number of startup success stories in the Southeast by leveraging a cross-regional, collaborative network of entrepreneurs, ecosystem builders, and investors. We believe in the power of community to support founders as they launch and scale their businesses.

Embarc Collective

Embarc Collective helps Tampa Bay’s startup talent build bold, scalable, thriving companies. Launched in early 2019, Embarc Collective’s offering is hands-on and driven by the specific goals and needs of each startup being supported.

Launch Tennessee

Launch Tennessee is a public-private partnership that supports entrepreneurs from ideation to exit, guided by a vision of making Tennessee the most startup-friendly state in the nation. Partnering with six regional Entrepreneur Centers, we create collaboration among the private sector, capital sources, institutions, and government to offer entrepreneurs what they need to build companies and create jobs in Tennessee.

HQ1

HQ1 believes in the financial upside of flyover country. We capitalize on this through early-stage investment, network building, education, and by always striving to be bold.

Back to All Posts

Back to All Posts