Learn about upcoming events and the latest startup news—delivered to your inbox weekly.

Last summer, we introduced the inaugural Southeast Capital Landscape Report. This year, the #BuildInSE Alliance and Embarc Collective have collectively revisited and refreshed the database to reflect the growth in the ecosystem. It remains our intention to maintain this resource to help connect local startups with funding opportunities across the region we call home.*

This year has not been the one that any of us would have expected. With the many challenges that 2020 has presented to our community, change is inevitable. However, within challenge and change therein always lies the silver lining of opportunity. We look forward to championing startups across the Southeast as they weather the storm, pivot best-laid plans, and find gaps to continue to #BuildInSE.

Build In SE and Embarc Collective present the updated 2020 Southeast Capital Landscape. Here’s what we found:

The Southeast is Growing

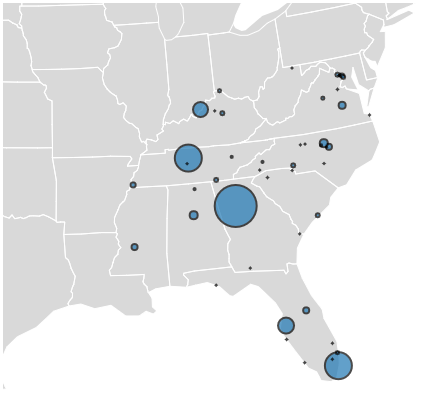

In the past year, the Southeast experienced nearly 20% growth in new angel network and venture firm creation, bringing the number of firms who are actively investing in pre-seed to growth stage startups from 200 to 240. Some notable debuts in the past year include:

- Atlanta-based Overline announced a $25M fund for seed stage investments in enterprise technology startups, led by Michael Cohn and Sean O’Brien.

- Black Angels Miami launched with a mission to increase the number of active Black angel investors by connecting them with high-growth pre-seed and seed stage investments.

- Orlando-based Calano Ventures quietly launched to invest in seed stage SaaS, eSports and e-commerce companies, having already garnered a portfolio of 8 investments.

Number of Firms by State

Firms by stage

Early Stage Still Leads the Way

Contrary to some beliefs regarding access to capital, early-stage funding accounts for the highest volume of funding sources in many geographies throughout the region. Over 66% of capital sources in the Southeast are directed at early-stage (pre-seed and seed) capital, or 158 of the 240 total firms identified. This capital is concentrated in five metropolitan startup locations where early-stage leads the way, including Atlanta, Nashville, Miami, Tampa Bay and Louisville.

However, startups are often required to look elsewhere for later-stage funding. Of the 240 firms identified, only 35 are directed at growth-stage investments, heavily concentrated in just a few states, including Florida, Georgia, Tennessee and Virginia.

As such, some of the “Southeast success stories” may stall out as they grow, or may have to look elsewhere to find the right capital partners throughout their entire lifecycle. We see a tremendous opportunity in the coming years as both businesses and capital providers mature in the Southeast.

It’s Time to Move the Needle

Our goal remains to help startups more easily find local capital resources and to help funding opportunities become better distributed throughout the Southeast. Our ask is that you put this database to use.

Startups, please use this landscape to build out your investor prospecting list among the breadth of early-stage capital resources in Southeast.

Investors, please use this landscape to share deals and co-invest alongside Southeast investors and fund the companies leading the future growth of the Southeast region.

Note: This is a list of capital providers of venture-backed startups in the southeastern United States that are currently active as a firm or investor. To include any firm or investor we did not already surface, please fill out this form.

*A reminder that for this project, we defined the Southeast as a collection of states including Alabama, Florida, Georgia, Kentucky, Mississippi, North Carolina, South Carolina, Tennessee, Virginia, & West Virginia. Data was aggregated and analyzed from PwC MoneyTree Reports, BIP Capital, Crunchbase, and self-reported by accelerators, entrepreneurs, and investors from within the region.

Meet The Collaborators

Collaboration, as demonstrated through this project, is vital to taking the Southeast to the next level in growing and retaining more high-value companies. Here are the organizations that helped make this report a reality:

Build in SE

At Build In SE, our mission is to increase the number of startup success stories in the Southeast by leveraging a cross-regional, collaborative network of entrepreneurs, ecosystem builders, and investors. We believe in the power of community to support founders as they launch and scale their businesses.

The #BuildInSE Alliance is a curated network of the Southeast region’s leading startup organizations that share a common mission to increase the number of startup success stories in the Southeast–including Atlanta Tech Village, Co.Lab, Raleigh Founded, Start.Co and Embarc Collective.

Embarc Collective

Embarc Collective is a 501c3 nonprofit that helps Tampa Bay’s startup talent build bold, scalable, thriving companies and currently supports over 40 early-stage technology startups. The support from Embarc Collective is hands-on and driven by the specific goals and needs of each startup being supported. Embarc Collective opened its 32,000 square-foot innovation hub at the start of 2020 in downtown Tampa at 802 E. Whiting Street Tampa, FL 33602.

Back to All Posts

Back to All Posts