Learn about upcoming events and the latest startup news—delivered to your inbox weekly.

Southeast Capital Landscape Report 2025

Introduction

The Southeast Capital Landscape is a database first launched in 2019 to bring visibility and clarity to the venture ecosystem across the Southeastern United States. By cataloging the region’s active venture firms and pairing that database with analysis of major trends, our reports help investors, founders, and ecosystem leaders understand how capital is flowing and where opportunities are emerging.

The project is a collaboration between Build In SE, a community-driven platform increasing visibility, capital, knowledge, and connectivity for founders and investors, and Tampa-based Embarc Collective, Florida’s fastest-growing startup hub. Together, we publish the Landscape to spotlight the firms shaping the Southeast and highlight the dynamics that set the region apart from other U.S. venture markets. Now in its sixth year, the Landscape has become a trusted reference point for stakeholders across the region. The 2025 edition builds on that foundation, surfacing not only data on firm activity but also the stories and signals that define today’s Southeastern startup ecosystem.

By the Numbers

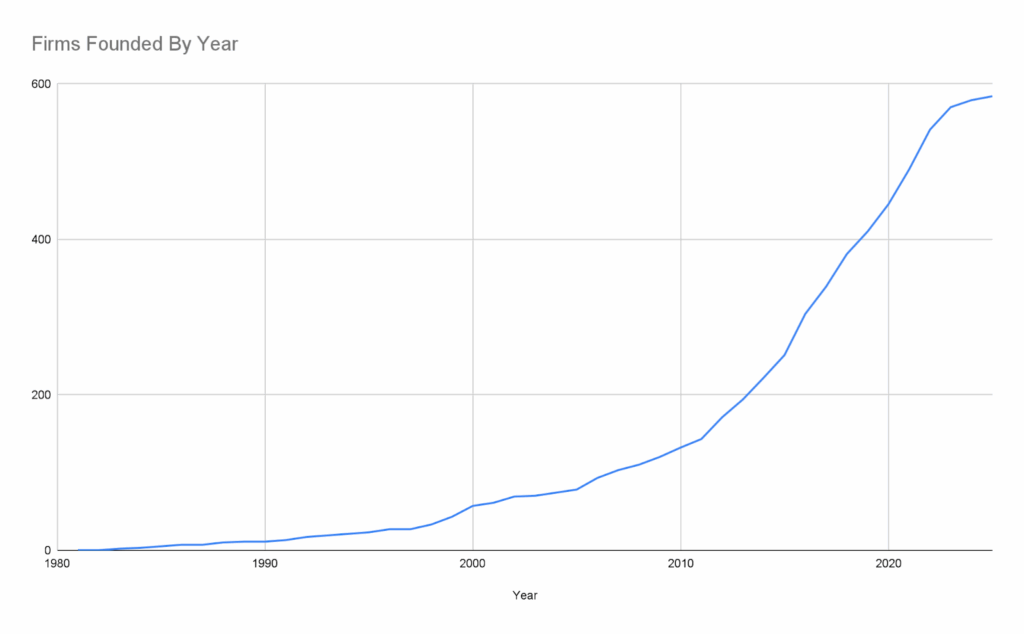

In 2025, there are nearly 600 venture capital firms and capital providers based or with significant presence in the Southeast. This number has ticked up steadily over time, and though the pace of net new firms has slowed since 2023, the region continues to be well-represented in the startup funding world.

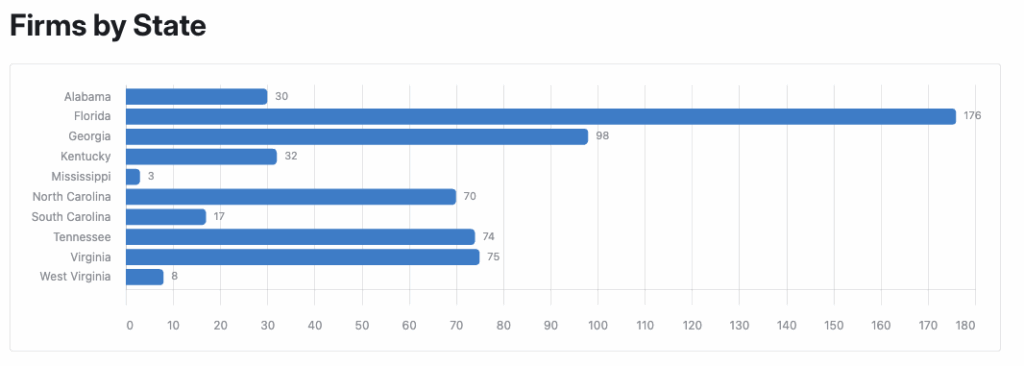

Florida leads the region with 176 firms, followed by Georgia, Tennessee, Virginia, and North Carolina rounding out the top five. Atlanta takes the top spot for cities, followed by Miami and Nashville.

View the whole database and interactive dashboards by visiting the Southeast Capital Landscape site page below.

Trend 1: From New Fund Formation to Sustainable Deployment

During the boom years of 2021 and 2022, the Southeast saw a wave of new venture firm formation – a rush of first-time micro-VCs, seed funds, and outposts of coastal firms looking to capitalize on the region’s growth amidst the COVID pandemic and other trends. Now, the pendulum has swung from rapid proliferation toward a focus on deploying capital sustainably and supporting existing funds. In short, the emphasis has shifted from “more funds” to “more funding” (from established vehicles) for startups. Data underscores this transition. The 2024 Southeast Capital Landscape report noted well over 100 new firms added since 2020, but in the past year the pace of new fund launches has cooled markedly. Nationwide, first-time VC fundraising has dropped sharply – the number of new U.S. venture funds raised in 2024 fell by 46% year-over-year (and 68% since 2021), and the count of first-time funds sunk to its lowest point in a decade (57% lower than 2023). The median time to close a VC fund has stretched to about 15 months – the longest in over a decade. This tougher climate is weeding out new managers without a track record. However, in undercapitalized regions like the Southeast, it’s become something of a tailwind for proven local firms: LPs are concentrating commitments with the standout players from Funds I/II, rather than spreading bets on brand-new entrants. As a result, leading regional funds (e.g. BIP Ventures in Atlanta, Florida Funders in Tampa, Cofounders Capital in NC, etc.) have been able to raise follow-on funds – albeit more deliberately – even as emerging managers find it challenging. The net effect is that Southeast investors are prioritizing fund deployment and portfolio support over spinning up new vehicles. Many of the young funds launched in the last 3–5 years are now heads-down, investing their capital and working to demonstrate returns, rather than seeking to spawn the next crop of managers. This maturation is healthy: it means capital raised in 2021 and 2022 is being put to work in startups, and GPs are focusing on sustainable operations (building proper firm infrastructure, cultivating LP relationships for the long term) rather than the frenetic fundraising of the past. The Southeast’s historically conservative investment style – making smaller initial checks and reserving for follow-ons – also positions it well in this environment. Investors who were disciplined during the hype are now able to double down on portfolio winners – BIP Capital highlights in their 2025 State of Startups in the Southeast report that “investors in the Southeast [continue] to eschew hype cycles and mega-deals in favor of supporting the continuity and durability of its businesses, funds, and investor community.” Indeed, by late 2024 the region showed faster follow-on funding cycles than the U.S. overall, indicating capital was actively being redeployed into scaling local startups rather than sitting idle. In sum, 2025 in the Southeast is less about the birth of new VC funds and more about the maturation of the many formed recently – a shift toward proving theses and building durable investment platforms. This trend should ultimately yield a more resilient venture ecosystem, as only the managers who can navigate the tougher fundraising climate and deliver value to startups will thrive, leading to a stronger cadre of long-term regional investors.

Trend 2: Proliferation of Government-Backed Capital

Another defining feature of the Southeast’s startup financing in 2025 is the growing role of government-backed capital programs. Both state and federal initiatives have injected fresh funding into the region’s venture ecosystem, often with the explicit goal of bridging capital gaps in less-served markets. Chief among these is the State Small Business Credit Initiative (SSBCI) – a federal program relaunched in 2022 that allocated nearly $10 billion to states to boost small business and startup funding. Southeastern states have put SSBCI dollars to work through newly created funds and partnerships.

Alabama’s Innovate Alabama is a standout example: Via its InvestAL venture program (a fund-of-funds under SSBCI), the state has begun seeding local VC firms and co-investing in startups. In April 2025, Innovate Alabama announced investments in two Alabama-based firms – gener8tor Alabama (an accelerator VC) and Measured Capital – designed to “close the venture capital gap for early-stage startups” and keep innovation financing rooted in-state. This strategy requires private co-investment (1:1 matching), effectively multiplying impact. Early results are promising: the partnered funds have already helped hundreds of Alabama startups raise tens of millions in follow-on capital, and demand for funding was so high that Alabama shifted more SSBCI money from loans into equity programs. Innovate Alabama also announced the launch of a venture studio in partnership with Birmingham-based Harmony Venture Labs, demonstrating other ways that government-backed programs can lay the groundwork for startup success stories. Another example is Alabama’s partnership with an external VC: Los Angeles-based Halogen Ventures received funding from InvestAL and in late 2024 committed to invest $10 million into building a pipeline of female founders in Alabama. By 2025, Halogen had already run pitch competitions in multiple Alabama cities and funded 10 startups in a single 48-hour period as part of this initiative – an injection of capital and support that may not have occurred without the state’s efforts.

Other states are similarly leveraging public capital. Tennessee’s InvestTN (part of “Fund Tennessee”) launched in mid-2023 to deploy $60+ million in SSBCI funding via local VCs and direct investments. Kentucky, Virginia, North Carolina, and others have rolled out venture funds, loan programs, and grants with their SSBCI allocations as well. West Virginia offers a unique model, where capital from the program remains with the funds and companies invested in – further aligning incentives in the ecosystem; notably, West Virginia was ranked in the top 10 nationally for efficient deployment of SSBCI capital in 2024, having approved over 90 investments totaling $23 million and catalyzing $42 million in additional private financing within two years. Beyond SSBCI, state-funded venture initiatives and tax incentives are proliferating. Florida, for instance, set up a new $100 million state-supported venture capital program in 2023 to stimulate tech startup growth. Georgia expanded R&D tax credits to encourage innovation investment, and Virginia and North Carolina have bolstered their state venture funds (Virginia Venture Partners was recapitalized with $173 million for local startups). Even federal agencies are stepping in: In October 2023, the U.S. EDA designated a South Florida Climate Resilience Tech Hub with ~$19 million grant funding, which local organizations are using to foster climate-tech startups in Miami and beyond.

These public-sector catalysts are lowering barriers for founders across the Southeast’s smaller markets. By de-risking early-stage capital (through matching funds, credit guarantees, or co-investments), government programs are crowding in private investors who previously might have overlooked the region, and adding fuel to a growing fire. The result is a significant increase in available capital – “patient” capital with public-purpose objectives – particularly in states and communities that historically lacked robust VC presence. In a region long undercapitalized relative to its population and innovation output, this infusion of government-backed funding is helping even the playing field and seeding the next generation of startups.

Trend 3: Cross-City Collaboration and an “Abundance” Mindset

A defining cultural trait of the Southeast’s startup ecosystem is its spirit of collaboration across cities and states – a stark contrast to the zero-sum competition seen in some other markets. The region’s investors and founders often speak of an “abundance mindset,” wherein success in one metro is viewed as lifting the entire Southeast, rather than detracting from others. This has fostered a high degree of cross-pollination: co-investment syndicates that span multiple states, multi-city networking events, and mentorship networks that readily bridge geographic gaps. As Lisa Calhoun of Valor Ventures (Atlanta) observes, “What’s happening among VCs and startups in the South is not so much competition as cooperation, which is very Southern. It’s creating a lifting mentality around regional innovation that is a joy to be a part of.” Rather than silo themselves, Southeast investors frequently partner on deals (e.g. a North Carolina fund leading a round with co-investors from Georgia and Florida) and share deal flow across metros. The proliferation of regional events such as Venture Atlanta, 3686 in Nashville, and Sloss.Tech in Birmingham also knits the community together, with founders from a broad range of cities getting exposure to capital from larger hubs.

Importantly, this abundance mindset extends to the relationship between the Southeast and outside investors: the region has welcomed increased interest from coastal VCs and corporate venture arms, viewing it as validation of the South’s potential rather than a threat. “There are places other than SF, Boston, and NY where you can find really smart people building meaningful businesses,” notes Santosh Sankar of Dynamo Ventures, highlighting how external investors have come to appreciate the Southeast’s talent. The partnership between Halogen Ventures and Alabama’s state funds is a great example: a Silicon Valley fund is collaborating with local stakeholders to nurture female founders in Alabama, rather than parachuting in competitively. In 2024, Halogen’s team traveled to cities like Birmingham, Montgomery, Huntsville, and even smaller college towns like Tuscaloosa, listening first and then investing alongside local groups. The result is a virtuous cycle – more national funds hunting for deals in the Southeast, more local startups getting funded, and more successes to go around. This collaborative approach, deeply rooted in Southern culture, has been a key ingredient in the region’s resilience and growth. By leveraging a “rising tide lifts all boats” philosophy, the Southeast is building an interconnected network where a promising startup in, say, Birmingham can tap resources and investors from Nashville to Raleigh to Miami almost as readily as if they were local. Alabama’s tech ecosystem, for instance, now spans multiple cities with different sector strengths (aerospace ventures in Huntsville, consumer product startups in Mobile, agtech in Dothan, fintech and SaaS in Birmingham, etc.), and investors see the state as one cohesive market to support. That bodes well for the sustainability of the ecosystem long-term: social capital and trust are often as valuable as financial capital in nurturing innovation. The Southeast’s emphasis on shared wins is helping it weather economic ups and downs better than many anticipated, and it’s creating a more inclusive regional economy. In summary, the Southeast’s collaborative, abundance-minded ethos is turning a once-fragmented landscape into a unified community – one where startups can grow with the help of a collective regional bench of supporters.

Trend 4: Shifting Sector Focus – Deep Tech, Defense, and Climate on the Rise

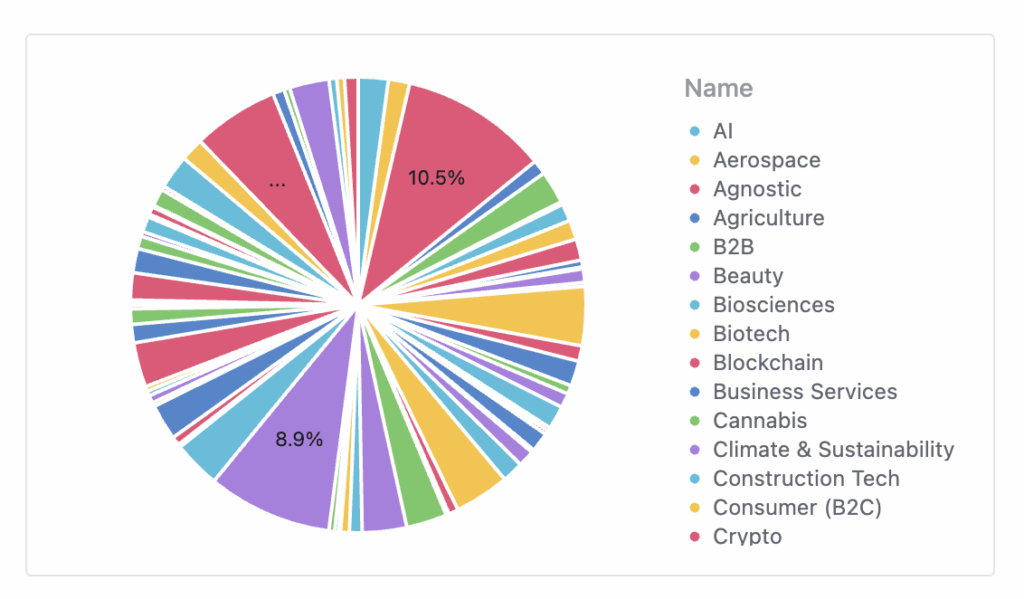

Beyond the macro shifts in funding dynamics, the Southeast is also experiencing clear trends in industry focus areas for new venture funds. Historically, many Southern investors gravitated toward sectors like fintech (in Atlanta’s “Transaction Alley”), healthcare (Nashville’s health services, Research Triangle’s life sciences), and real estate or logistics (reflecting regional industry bases). While those strengths remain, recent years have seen notable shifts and specializations emerge. In particular, there is a surge of interest in deep tech, aerospace/defense, and climate technology among the region’s venture firms – focus areas that align with national priorities like energy independence, national security, and supply chain reshoring.

One way to see this is through the database of Southeast VC firms: among firms founded since 2020, a significantly higher proportion explicitly list “Deep Tech,” “Aerospace,” “Defense,” or “Climate & Sustainability” in their investment mandates compared to older firms. For example, new funds like AeroX Ventures in North Carolina and AIN Ventures in Northern Virginia were launched with theses centered on aerospace and defense innovation. AeroX’s mandate covers “early-stage companies transforming aerospace, defense, [and] deep tech”, while AIN (short for Academy Investors Network) focuses on “the intersection of deep technology and dual-use (military and civilian) technology”. In Raleigh, NC, BlueLake Ventures launched to back “frontier” startups in robotics, advanced manufacturing, supply chain, security, energy, and aerospace – essentially a deep-tech roster. And corporate players are entering the mix: RTX Ventures (the venture arm of Raytheon, based in Arlington, VA) began seeding startups that “will transform aerospace and defense”, and Booz Allen Ventures (McLean, VA) is similarly targeting cyber, defense, and AI-related tech.

Geopolitical tensions and federal spending trends are likewise driving defense and aerospace tech interest. Venture funding for defense tech startups climbed to $3.0 billion in 2024 (an 11% increase year-over-year), and investors who once shied away from defense are now engaging due to both mission-oriented and financial reasons. “Investors have become far more intelligent about defense in the last few years…dollars are being deployed more efficiently,” said Ethan Thornton, CEO of a defense-tech startup. The Southeast is naturally positioned to capitalize: it is home to numerous military bases, defense contractors, and space infrastructure (from NASA’s Kennedy Space Center in Florida to the Redstone Arsenal and Space Command in Alabama), and Southeastern venture firms are aligning with this reality. Several funds explicitly mention supporting “technologies critical to national and economic security” – for instance, AE Industrial Partners in Florida concentrates on industrial and aerospace deals tied to national security. In Northern Virginia, funds like Blue Delta Capital and FedTech specialize in government and defense-oriented startups (Blue Delta focuses exclusively on U.S. government services tech). Another Virginia firm, Outpost Ventures, is a veteran-owned fund backing AI, mobility, space, and energy technologies with an aim to capture value from U.S. government innovation mandates. These investors are tapping into DoD’s increased openness to startup collaboration (e.g. AFWERX, SpaceWERX programs) and the larger budgets earmarked for defense R&D. As Daniel Ateya, president of RTX Ventures, put it, the rise in defense tech interest is driven by “an increasingly fraught geopolitical landscape and heightened demand from defense customers and Congress to support new firms”. Key technology themes like autonomous systems, AI, advanced propulsion, and space tech are attracting strong interest– all areas where we see Southeastern startups (from space-launch companies in Florida to autonomy and drone startups in North Carolina) securing capital.

On the climate and sustainability front, the Southeast’s investors are also ramping up. A number of new funds explicitly branding around climate have emerged from Miami to Birmingham. Better Tomorrow Ventures in South Carolina and Z2Sixty Ventures in Atlanta, for example, list Climate Tech alongside fintech or healthtech in their early-stage portfolios. Florida has Clear Current Capital focusing on sustainable food systems (plant-based proteins and climate-friendly foodtech), and Novelis Ventures (Atlanta) was launched by aluminum giant Novelis to invest in low-carbon manufacturing and circular economy startups. The AgLaunch accelerator in Tennessee added a Climate & Sustainability mandate to its traditional agtech focus. Meanwhile, established impact funds like SJF Ventures (Durham, NC) doubled down on climate/energy, backing mobility, solar, and grid startups. The data shows that 14 Southeast-based firms in our database cite “Climate & Sustainability” as a key sector – half of which were founded just in the last few years (2020 or later). In short, climate tech has moved from a niche to a pillar of the Southern venture scene, and the Southeast, with its abundant sunshine, offshore wind potential, and risk of climate impacts, stands to benefit. In South Florida, climatetech was the only sector to see an increase in deal activity in 2023, securing $263 million across 31 deals. And across the region, the push for energy independence has catalyzed massive industrial projects that create venture-scale opportunities: by mid-2024, Southeastern states had attracted $78.2 billion in announced EV and battery manufacturing investments (38% of all U.S. EV manufacturing investment), bringing tens of thousands of jobs. Local venture firms have taken note – many are looking at startups in EV charging, battery recycling, grid resiliency, and clean fuels that can plug into this industrial resurgence. For example, Atlanta-based JTEC Energy (developing a new heat-to-electricity engine) raised $30M in 2022 from regional VCs, and Durham’s energy storage startup FlexGen raised a $100M Series C, signaling that Southern investors will back big climate/energy bets.

The Southeast’s focus on manufacturing, supply chain, and “deep tech” also ties into the nationwide effort to rebuild domestic industrial capacity. The CHIPS Act and bipartisan calls to reduce reliance on foreign supply chains have funneled resources into semiconductor fabs, battery plants, and advanced materials – many of which are landing in Southern states. For example, North Carolina is now home to a major new semiconductor materials plant (Wolfspeed’s silicon carbide fab) and multiple EV battery factories; Georgia is building an EV supply chain around new Hyundai and SK Battery facilities. Venture firms in the region are aligning their theses accordingly. Funds like Atlanta’s Engage and Knoll Ventures have backed startups in manufacturing automation and industrial software, and Tennessee’s Meritus Ventures (an older fund) is seeing renewed interest as it targets rural manufacturing and industrial tech. The Materials & Resources sector, long a tiny sliver of Southeast venture, is now “increasingly strategic…investors are targeting industrial tech, cleantech, and supply chain modernization”, according to BIP’s 2025 analysis. Even traditionally consumer-focused firms are dabbling in “hard tech” when it overlaps with regional strengths – e.g. several Southeast funds have invested in local space startups (such as Atlanta’s Hermeus, building hypersonic aircraft, and Orlando’s Sidus Space in satellite hardware). The overall trend is a broadening of the Southern venture palette: where a decade ago software and healthcare dominated, today there’s far more diversification into frontier industries.

Crucially, these emerging sector focuses are not coming at the expense of the Southeast’s bread-and-butter sectors, but rather augmenting them. Information Technology and SaaS still account for the lion’s share of deals by volume (often enabled by embedded AI), and healthcare/biotech remains a stronghold (especially in NC and TN), as highlighted in BIP Ventures’ 2025 State of Startups in the Southeast report. Fintech cooled slightly after a 2021–22 peak, but continues to see selective investment in infrastructure and “Fintech 2.0” plays (e.g. AI-driven compliance or payments solutions). What’s changing is that capital is spreading into new areas that were previously underfunded in the region. The Southeast’s sector diversity is becoming a strength that mitigates risk, rather than a weakness. The rise of deeptech, defense, and climate funds in the region exemplifies this pragmatism: these are long-term bets on transformations that are well underway nationally. By aligning venture capital with energy, security, and industrial policy priorities, Southeastern investors are carving out a role in the next era of tech. In doing so, they are also helping ensure the region isn’t left behind as innovation shifts beyond pure software. Expect to see more specialist funds and incubators in the South focusing on things like climate resilience, space tech, AI at the edge, and advanced manufacturing – the building blocks of the future economy.

Call to Action: Share the report and database

The Southeast funding ecosystem in 2025 continues to mature, and while the fervor and pace of the early 2020s has slowed, the ability of firms in the region to successfully deploy capital and make a positive impact on startups in the region is as strong as ever. We hope that the Southeast Capital Landscape helps founders, operators, and other individuals in the startup community as they navigate the complexity of building great, world-changing businesses.

View the whole database and interactive dashboards by visiting the Southeast Capital Landscape site page.

Meet the Collaborators

Collaboration, as demonstrated through this project, is vital for the Southeast to become a vibrant destination to grow and retain more high-value companies. Here are the organizations that helped make this report a reality:

Build in SE

Build In SE is a Nashville-based Benefit Corporation building a collaborative network of startup founders, funders, and ecosystem supporters across the Southeast. Our mission is to increase the number of startup success stories by building regional intelligence, bringing together capital, events, and research for founders choosing to #BuildInSE. To learn more and get involved, visit buildinse.com.

Embarc Collective

Embarc Collective, a 501c3 non-profit, is an innovation leader and a central landing zone for Florida’s most driven and focused early-stage tech startup builders. Our globally-recognized startup platform offers founders curated programming, on-demand coaching and mentorship, connectivity to corporates, universities, and investors, and engagement with a peer community of 330+ founders and founding team members that lead 140+ Florida-based early-stage tech startups and growth-stage companies in healthcare and life sciences, cybersecurity and data analytics, AI and deep tech, financial and legal services, and defense and national security, among other sectors within an award-winning 32,000-square-foot startup hub in downtown Tampa, Florida. Since its inception in 2019, member-companies have achieved a 96% survival rate, created 1,200+ high-paying tech and tech-enabled jobs, and secured more than $650M in seed, venture, and growth equity, including more than half from investors outside the state of Florida, while driving almost $200M annually in direct and indirect economic returns to the state of Florida.

Back to All Posts

Back to All Posts