Learn about upcoming events and the latest startup news—delivered to your inbox weekly.

Florida’s tech ecosystem took the spotlight as Embarc Collective hosted its first-ever Venture Capital & Growth Equity Summit, powered by KKR and FTV Capital. The event convened more than 40 growth-stage tech companies from across Florida alongside 30+ venture capital and growth equity firms representing hubs from California to New York, Tennessee, Georgia, and beyond.

With Florida’s tech startups still facing notable venture capital gaps, this Summit proved especially timely and impactful. It highlighted emerging companies with strong growth potential while equipping founders with actionable strategies to scale effectively and create long-term value. Beyond deal-making, the Summit sparked meaningful connections, encouraged bold thinking, and energized the state’s innovation ecosystem—serving as a powerful catalyst for Florida’s next generation of entrepreneurial success.

We kicked off day one with Ken Hall’s session, providing valuable insight on the current state of Florida’s innovation economy, followed by keynote speakers, panel discussions, and founder presentations:

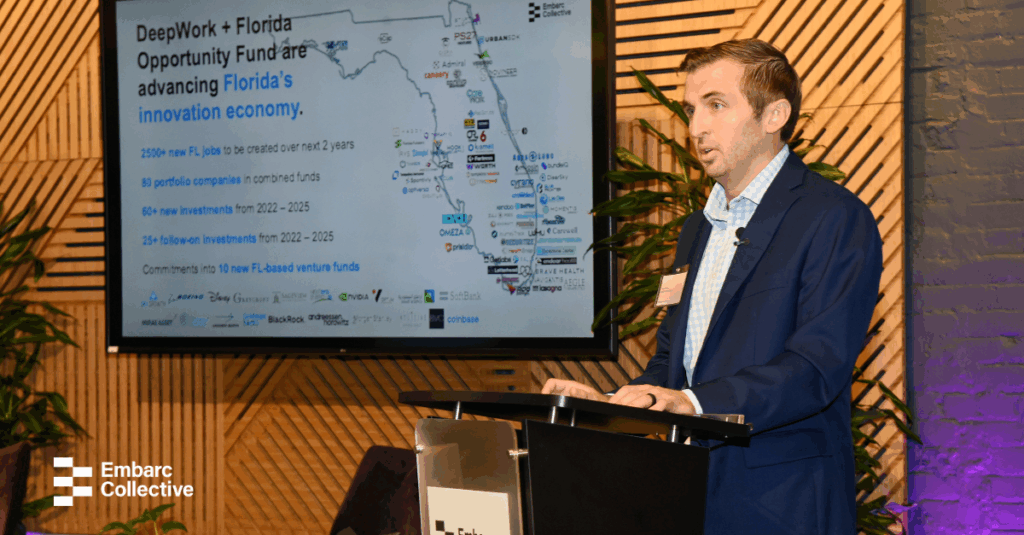

“Institutional Capital Across Florida” featuring Ken Hall, Partner at DeepWork Capital

Ken Hall, Partner at DeepWork Capital, spotlighted a striking paradox in Florida’s innovation economy: the state boasts strong fundamentals—from top-tier talent and R&D to a business-friendly climate and booming migration—but consistently captures less than 3% of U.S. venture capital. Deal activity and valuations have slipped back to pre-pandemic levels, while institutional investors funnel most of their venture commitments out of state, leaving local VC firms without the scale needed to fund growth-stage companies. The result? Smaller rounds, limited local participation in $25M+ growth deals, and a heavy reliance on angels and out-of-state investors, with just 6.5% of Florida’s $24B in exit value actually staying in-state.

Ken argued that the solution lies in better alignment between limited partners, fund managers, and policymakers. By boosting in-state LP commitments, scaling proven local funds, and rethinking institutional incentives, Florida could retain far more venture capital and unlock billions in value. “The state doesn’t lack founders or opportunity,” Ken noted—“it’s a structural capital allocation problem that, if solved, could catapult Florida into the ranks of the nation’s top-tier innovation hubs.”

“Founder Mindset Shifts” featuring Brian Murphy, Founder & CEO of ReliaQuest, and Chair of Embarc Collective

Brian Murphy shared lessons from ReliQuest’s journey from a Tampa IT-billing shop to a $3.4B cybersecurity platform. For founders, the key takeaways are clear: focus on solving a core problem—cybersecurity is a data problem, not a people problem—build systems that scale with automation, and be willing to pivot boldly when market opportunities shift. ReliaQuest’s disciplined pricing, rapid detection platform, and commitment to recurring revenue highlight the importance of operational rigor and financial discipline

Brian also discussed building and scaling a high-performing global team, the importance of disciplined pricing and strategic capital partnerships, and his commitment to Florida’s tech ecosystem through Embark Collective. Looking forward, ReliaQuest is preparing for an IPO, continued innovation against AI-powered threats, and ambitious market expansion, all while maintaining operational excellence and talent growth.

Venture and Growth Equity Investor Panel

Moderator: Dave Willbrand, CLO, EVP, & Corporate Secretary | Legal, People, & Corporate Affairs

Panelists:

- Ben Pederson, Managing Director, KKR

- Richard Liu, Partner, FTV Capital

- Melissa Medina, Partner, Medina Ventures and President & CEO, eMerge Americas

- Junior Gaspard, Principal, Fulcrum Equity Partners

The session dove into what really matters when raising growth equity for scaling companies: it’s all about execution, metrics, and the right team. Investors look for repeatable customer acquisition, strong leadership (think VP Sales, CRO, revenue ops), and founders who are true partners—transparent, self-critical, and willing to fail fast while leveraging investor expertise. Common missteps include overstated metrics, fuzzy segmentation, underpriced costs, and a team that isn’t evolving alongside the company. Interestingly, moderate founder liquidity is now seen as a positive when it de-risks and frees founders to make bold moves.

For founders, the advice was clear: build strong metrics, codify your ICP, under-promise and over-deliver, and keep investors in the loop with regular updates. Florida-based companies can highlight local advantages like talent access, lower costs, and ties to the defense sector. Applied AI that delivers measurable lifts in margin, retention, or annual contract value can really set a company apart. Above all, transparency, professionalism, and frequent investor touch points were stressed as the foundation for trust and successful growth-stage fundraising.

“Choosing Your Own Capital Path” featuring Trevor Clark, Founder & CEO of Shyftoff

Moderator: Ryan Schneider, Co-Founder and CEO, Thrive25 & Executive Strategy Coach, Embarc Collective

In a session focused on the real calculus behind raising capital, Trevor Clark, Founder and CEO of ShyftOff, shared a grounded perspective on how founders can decide if outside investment is right—and when it actually adds value.

Trevor’s experience operating large contact centers at Frontier Communications exposed a persistent inefficiency: demand peaks often came after traditional business hours, but fixed W-2 staffing couldn’t flex to meet it. ShyftOff was born from that insight—an “Uber-like” workforce model built to help enterprises dynamically scale their customer-support capacity.

Rather than racing to fundraise, Trevor let customer revenue drive early growth. On-demand, high-volume projects—like TurboTax’s seasonal surges, hurricane response efforts, and breach recovery operations—generated millions in cash flow that sustained operations and financed experimentation. This customer-funded approach bought ShyftOff something many founders lack: time and leverage.

When the company did pursue a seed round led by Florida Funders, the goal wasn’t survival—it was acceleration. With a proven model and repeatable demand, outside capital became a tool to professionalize the platform and strengthen go-to-market execution, not a lifeline.

Throughout the conversation, Trevor outlined how founders can evaluate capital decisions through a disciplined lens:

- Start with sustainability. Build toward profitability and efficiency before seeking capital.

- Be intentional about timing. Only raise when funding unlocks growth you can’t achieve through revenue.

- Know your investor fit. Understand the difference between venture capital’s growth expectations and growth equity’s focus on fundamentals.

- Maintain control and transparency. Clear communication and aligned expectations preserve trust and flexibility.

Trevor’s central message: capital should accelerate momentum, not manufacture it. By grounding decisions in data, customer traction, and operational clarity, founders can scale sustainably—proving that disciplined, revenue-led growth can be just as powerful as venture-backed speed.

Alternative Venture Financing Panel

Moderator: Saxon Baum, Partner, Florida Funders

Panelists:

- Alan Faulkner, Managing Director, Venture Banking, Stifel

- Andrew Lane, Market Director and Executive Director for Technology, Disruptive Commerce & Internet, Innovation Economy, J.P. Morgan

- Jordan Parcell, Managing Director, Silicon Valley Bank

This panel discussion offered a masterclass in smart, flexible financing beyond traditional equity, showing how startups can strategically leverage venture debt, working capital lines, ARR-backed facilities, and tailored CapEx structures to extend runway, fund growth, and preserve equity. Banks emphasized early relationship-building, aligning lending with board-approved KPIs, and structuring debt in ways that complement equity rounds rather than creating misaligned pressure. Across the spectrum—from SVB supporting pre-revenue insurance startups to JPMorgan enabling regional enterprise growth—these instruments act as optional “dry powder”, giving founders breathing room to scale without forcing unfavorable equity raises.

Founders were advised to engage lenders shortly after equity closes, align with their boards on milestones, and choose the instrument that best fits their business model—be it SaaS ARR, capital-intensive hardware, or professional services growth. Optionality and flexibility are central: undrawn facilities serve as insurance against market shifts, warrants and covenants are calibrated to preserve founder upside, and collaboration across banks, VCs, and private credit ensures founders aren’t boxed into one path.

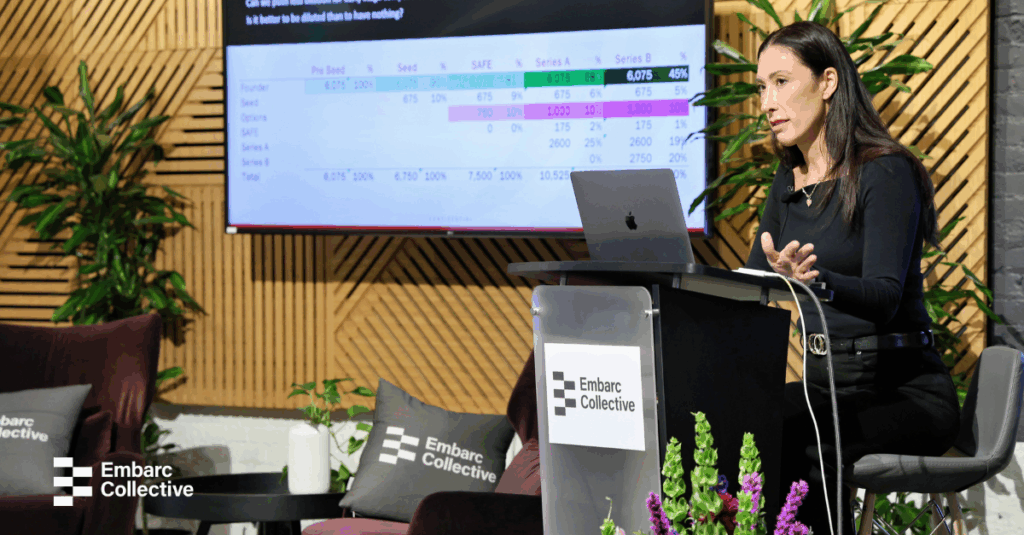

“Cap Table Management” featuring Daniela Tumusko-Yoder, CFO at Triage Partners LLC

Daniela Tumusko-Yoder walked founders through the mechanics of cap table management, dilution, and exit waterfalls, showing how early decisions ripple through every financing stage. From SAFEs and option pools to Series A/B pricing and preference stacks, she highlighted how seemingly small choices—like option pool sizing or SAFE discounts—can materially shift founder ownership and investor ROI. Practical frameworks like the VC method, market comps, and DCF models help founders triangulate valuations, justify raises, and anticipate dilution, ensuring every dollar raised drives enterprise value rather than unintended erosion of founder equity.

Daniela’s session reinforced a key principle: model everything, align with milestones, and treat valuation as an operational lens. Founders should track fully diluted cap tables, negotiate preference and option pool placement thoughtfully, and plan runway precisely to match growth and investor expectations. With disciplined cap table management, startups can preserve founder upside, attract top talent, and structure rounds that satisfy both the company’s strategic goals and investor return targets—turning complex equity mechanics into a strategic growth lever.

“Preparing for Strategic M&A Exits” featuring Clinton Johnson, Managing Director and Board Member at Benchmark International

Clinton Johnson emphasized that for founder-led companies, practical M&A is usually a more realistic exit than an IPO. IPOs are costly, time-intensive, and rarely provide immediate founder liquidity, while M&A allows staged exits with partial rollover equity, aligning incentives and enabling founders to continue driving growth. Key levers include structuring earnouts, seller notes, and rollover equity thoughtfully, understanding buyer financing constraints, and preparing for due diligence with disciplined financials, operating metrics, and documentation.

A central takeaway: always be ready to sell. Founders should cultivate relationships with strategic buyers and PE sponsors years in advance, maintain clean accounting and KPI reporting, and predefine deal guardrails for rollover, earn-outs, and preferred terms. By treating exit planning as an operational discipline—tracking pipeline, retention, pricing, and employee data—founders preserve optionality, maximize valuation, and navigate both financial and emotional complexities with confidence, turning an eventual sale into a strategic growth milestone rather than a reactive scramble.

A portion of day one included Embarc Collective’s Growth-Stage founders with a unique opportunity to showcase their companies to our audience of leading investors and industry peers. This was an invaluable portion of the Summit, giving Summit attendees a chance to learn about new technologies for potential investment. Check out the companies that presented:

Embarc Collective Growth-Stage Founder/CEO Presentations

Shyftoff | Trevor Clark, Founder & CEO at Shyftoff, with Tom Wallace, Managing Partner at Florida Funders

ShiftOff is redefining contact center operations through an AI-powered, gig-economy platform serving regulated industries like financial services, healthcare, and insurance. By combining AI automation with top-tier human agents, Shyftoff delivers 35–55% cost savings and precise, on-demand staffing across 17,000 active agents.

Trustate | Leah Del Percio, Co-Founder & CEO of Trustate + Fernando Higuera, VP of Technology & AI at Trustate, with Laura Stein, VP at Ballast Point Ventures

Trustate helps trust and estates lawyers streamline complex client data through an AI-driven workflow platform now used by nearly 1,000 law firms—doubling its user base year-over-year. Its proprietary legal dataset and agentic AI deliver secure, structured insights while protecting sensitive information. Nearing profitability and $3.5M ARR, Trustate plans to raise $10M to expand into adjacent legal areas like divorce, real estate, and litigation, continuing its focused, data-led growth strategy.

Pieces | Tsavo Knot, Co-Founder and CEO at Pieces, with Mark Richey, Co-Founder and Managing Partner at 1809 Capital

Pieces is building an “artificial memory” platform that helps professionals and teams instantly recall context across their digital work—from code reviews and emails to documents and discussions. Originally a developer tool for managing snippets, it now serves thousands of users and organizations, using its Model Context Protocol (MCP) to let AI agents retrieve context securely from on-device data.

Tesseract Ventures | John Boucard, Co-Founder and CEO at Tesseract Ventures, with Jason Rottenberg, Co-Founder and General Partner at Arsenal Growth.

Tesseract Ventures builds custom robots, sensors, and predictive software for real-time intelligence across defense, construction, critical infrastructure, and agriculture. Commercial-first but defense-capable, Tesseract Ventures has raised $24M and is preparing for a Series B to scale operations. Its platforms—Mosaic for construction analytics and Synthesis for agricultural forecasting—reflect an end-user-driven approach, making environments safer, more efficient, and better connected.

Satisfi Labs | Donny White, Founder and CEO at Satisfi Labs, with Andreas Calabrese, General Partner at TampaBay.Ventures.

Satisfi Labs operates an agentic AI platform with 2,500+ agents across 800+ clients, generating $10M+ ARR and serving major sports and entertainment brands like the Tampa Bay Buccaneers, Rays, Lightning, Zoo Tampa, and Universal Studios. Its AI agents handle operational roles—ticketing, guest experience, and safety—driven by measurable OKRs to deliver tangible outcomes.

TrustLayer | John Fohr, Founder and CEO at TrustLayer, with Rob Panepinto, Managing Parnter & CEO of Govo Ventures

TrustLayer provides a collaborative risk management platform that automates document collection, compliance checks, and contract comparisons for complex multi-project relationships across industries like construction, hospitality, and franchises. Serving over thousands of companies and half of the top 100 insurance brokers, the platform boosts risk professional productivity 4–5x through workflow automation and AI-driven document processing.

Grifin | Aaron Froug, Co-Founder and CEO at Grifin, with Julia Taxin, General Partner at Grotech Ventures.

Grifin is a consumer fintech app that turns everyday spending into investments, making finance accessible for first-time investors through simple, human-centered design and habit-forming features like streaks. Since shifting to a subscription model in 2024, the app has grown from $0 to $4M ARR, reaching primarily women aged 40–60 while maintaining viral engagement with younger users.

Back to All Posts

Back to All Posts